OUR FIRM

About W Investments

Our Independence is Your Advantage

W Investments is a fully independent, partner-owned and operated financial services firm. Our independent structure is designed to help eliminate the distractions often encountered by advisors operating in large corporate-owned firms.

For our investment advisory clients, our business model and approach allow us to act like fiduciaries, which means our clients best interests should always come first.

- We provide personalized financial guidance and strategies.

- We answer directly to you, our client – not to a corporate parent or stockholders – and since we’re not product manufacturers or distributors we’re able to maintain independence throughout the planning and investment process.

- Our independence enables us to provide you with strategic financial guidance tailored to your individual needs and circumstances.

- We believe it’s in your best interest to manage your assets with full access to independent research.

PRODUCTS AND SERVICES

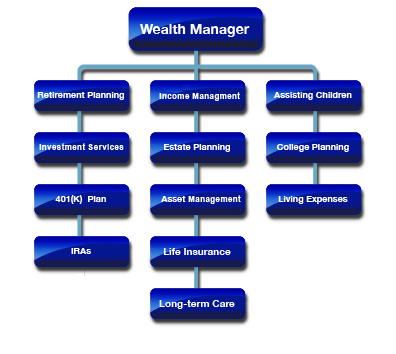

W Investments delivers customized wealth management services and tailored services to address a broad range of financial needs. Contact us today to discuss how we can help you pursue your unique financial goals and objectives.

W Investments

Personal Financial Planning

Financial planning is at the very core of the life planning services we provide to individuals and families seeking to build, preserve and manage wealth over time.

Retirement income planning, education planning, tax and estate planning, and risk management services are components of a larger, more comprehensive financial plan designed to work towards multiple financial and lifestyle goals. Your plan also provides for your heirs and defines the legacy you choose to leave.

Our Approach to Asset Management through LPL Financial

Our clients require sophisticated and attentive asset management to try and maximize their portfolios’ total returns in light of their risk tolerance. We construct each investment portfolio after an extensive analysis of your risk tolerance, investment objectives and time horizon.

After ascertaining these factors, we design an investment strategy to pursue your needs, based on this investor profile. The key to effective asset management is creating and maintaining a diversified investment portfolio that is designed to work for many years.

Retirement Planning

Whether you are in the accumulation phase or have already retired, a sound strategy is crucial to:

- Meeting your retirement income needs, desires and expenses

- Maintaining lifestyle choices and priorities

- Ensuring that long-term goals and aspirations are funded for travel, healthcare, estate planning, charitable giving and other goals

We can help you develop a comprehensive strategy to:

- Identify and pursue your lifetime income goals

- Minimize taxes on income—now and during retirement

- Evaluate the variables in your retirement plan to ensure alignment with your objectives

We can help you manage your:

- Retirement Plans

- 401 (k) Plans

- 403 (b) Plans

- Money Purchasing Plans

- Profit Sharing Plans

- Tax Strategies

Nearly all financial decisions have tax ramifications. Tax liabilities associated with income, estate, gift and various state, excise and sales taxes can take a real toll on your wealth. Our team of experienced professionals can help coordinate the various aspects of your finances to manage taxes and develop tax-efficient strategies in line with pursuing your overall financial goals.

Risk Management Services

Protecting yourself, your loved ones, your home or your business against unexpected events is a fundamental aspect of financial planning. Closing the gap on potential risks can be tricky without a comprehensive plan and process that methodically evaluates all potential risk factors.

That’s why risk analysis is an integral part of our ongoing process. We continually identify and analyze all risk factors and make tailored recommendations for:

- Disability Income

- Life Insurance

Long-Term Care

When planning for long-term healthcare needs, it’s important to keep in mind that:

- Medicare is not nursing home insurance and does not cover long-term care

- Private medical insurance or Medicare supplement plans do not cover maintenance care

Long-term care insurance can help manage healthcare costs and reduce the impact of inflation, while ensuring your healthcare needs, and those of loved ones, are covered well into the future. Adequate financial planning now can help prevent a lifetime of assets from falling short when you need them most.

Education Planning

Whether you’re paying tuition costs now or saving for a future goal, it’s important to ensure that your education strategy is compatible with your retirement income and related financial objectives. Tax considerations and retirement income needs must be weighed and evaluated before choosing a specific strategy. It’s important to remember that while education expenses can be funded through borrowing, retirement expenses cannot.

Since we’re an independent firm, we’re under no pressure to recommend proprietary education savings programs or investment products. Our only concern is which program best addresses your needs. The following are among the most popular education savings plans available today:

- 529 Plans

- Coverdell Education Savings Accounts

- Uniform Gifts to Minors Act (UGMA)

- Uniform Transfers to Minors Act (UTMA)

Estate Planning Strategies

Preserving wealth from one generation to the next can be complex and time-consuming. Guidance from a competent, experienced advisor can go a long way toward helping make sure your financial success is shared with your family, friends and the charitable organizations you designate, according to your wishes.

We will help you articulate your estate planning goals and we will work closely with your tax and legal advisors to ensure your financial plan reflects your estate planning needs. Or, if you prefer, we can provide our own team of professional advisors adept at the intricacies of estate and tax planning. Whether you use a trust or another method for accomplishing your long-term estate planning goals, we can assist you in navigating today’s complicated tax and estate laws.

*LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

Legacy Planning and Charitable Giving

Charitable giving can provide tax benefits for you and your heirs. A full assessment of the short and long-term tax and estate planning implications is conducted to help you achieve these objectives.

LOCATE US

EL DORADO OFFICE

Address:

101 N. Main

El Dorado, KS 67042

LPL FINANCIAL

LPL Financial is one of the nation’s leading financial services companies and a publicly traded company on the NASDAQ under ticker symbol LPLA.

The firm’s mission is rooted in the belief that objective financial guidance is a fundamental need for everyone.... Learn More

IHT WEALTH MANAGEMENT LLC

IHT is a firm built by financial advisors, for financial advisors. Our ultimate responsibility is with our clients, not shareholders and corporate executives worried only about their bottom line. Our model creates a newfound sense of freedom that both investors and experienced financial advisors want and deserve. IHT is an LPL affiliated Hybrid RIA that is SEC registered. The hybrid affiliation provides us with the full LPL platform while allowing IHT to maintain true independence to service our clients. Each advisor truly owns their own practice while also taking advantage of economies of scale by affiliating under one national brand.

Learn more