As central bankers, economists, and policymakers gathered last weekend in Wyoming’s Grand Teton National Park for the 2025 Jackson Hole Economic Symposium, the Federal Reserve (Fed) found itself at a critical juncture marked by political pressures, personnel changes, and internal divisions over monetary policy direction. Markets have positioned for dovish signals with 85% odds of a September rate cut, but historical patterns suggest Jackson Hole speeches often trigger reversals, as seen in 2022 when 2-year Treasury yields surged over 100 basis points following Fed Chair Jerome Powell’s hawkish remarks. The Fed’s simultaneous management of interest rate policy, personnel changes, quantitative tightening, and mounting political pressure from the White House represents an unusually complex policy environment. Fixed income investors face elevated volatility across markets as the institution that has long prided itself on independence and consensus navigates both external political pressures and internal disagreements during a period of mixed economic signals.

Jackson Hole Economic Symposium

The Kansas City Fed’s annual symposium, from August 21-23 with the theme “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy,” has long served as the world’s most exclusive economic gathering. What began in the early 1980s as a way to entice Fed Chair Paul Volcker through excellent fly-fishing opportunities has evolved into the premier venue for monetary policy announcements. The symposium’s 100-120 attendees have witnessed landmark moments, including Ben Bernanke’s 2010 signal for a second round of quantitative easing, Mario Draghi’s 2014 groundwork for European stimulus, and Jerome Powell’s 2020 introduction of average inflation targeting. This year’s gathering carried particular weight as Powell delivered what was likely his final Jackson Hole address as Fed chair, with markets placing roughly an 85% probability on a September rate cut before his comments but priced in a near certainty of a cut after his remarks were made public.

Highlights from Jerome Powell’s Jackson Hole Speech:

- Softer employment data has likely pushed the Fed toward rate cuts at their September 17 meeting. A well telegraphed statement removes some of the uncertainty plaguing investors.

- Yields plummeted and equities rallied from the increased clarity about future rate decisions.

- Since last year’s Jackson Hole event, the upside risks to inflation have diminished and the unemployment rate has increased by almost a full percentage point (3.4% to 4.2%), a development that historically has not occurred outside of recessions. We think recession risks are low despite concerns that Q3 GDP growth will flatline.

- Tariff effects will be short-lived but not necessarily felt all at the same time. “It will continue to take time for tariff increases to work their way through supply chains and distribution networks.” We expect inflation metrics to accelerate over the next several months.

- Although not as exciting, Chair Powell discussed in his speech the four main revisions to the policy framework, a review the Fed does roughly every 5 years. Demographics, fiscal policy, and other factors suggest that the long-term neutral fed funds rate is likely higher than during the 2010s.

Bottom Line: The macro-outlook should convince the Fed to cut rates at the September 17 meeting. The hint of upcoming rate cuts will tamp down yields and bolster markets in the near term. But looking out on the horizon, structural shifts in the economy have created uncertainty about the long-run fed funds rate. Suffice it to say, the neutral rate will be higher than during the 2010s.

Monetary Mayhem at the Federal Reserve

The timing of this year’s symposium coincided with changes in Fed leadership that began earlier this summer and remain ongoing. In early August, Adriana Kugler, who had served as a Fed governor since September 2023, unexpectedly announced her resignation, stepping down six months before her term was scheduled to expire on January 31, 2026. As well, Powell’s chairmanship tenure ends May 2026. President Trump and Treasury Secretary Scott Bessent are vetting potential candidates and are expected to announce the next Fed chair in the coming months. Finally, late last week, accusations of mortgage fraud by Fed Governor Lisa Cook (but importantly, no formal charges have been made) drew Trump’s ire, and he stated that he would fire her if she didn’t resign.

President Trump moved to fill Kugler’s vacancy, announcing on August 7 his nomination of Stephen Miran, the current Chairman of the Council of Economic Advisers, to serve in Kugler’s seat through January 2026. The nomination represents Trump’s first attempt to reshape the Fed during his second term, though notably only on a temporary basis. Trump explicitly stated he would “continue to search for a permanent replacement,” suggesting Miran’s role may serve as a bridge appointment while the administration identifies a longer-term candidate.

Miran brings considerable economic policy experience, having served as a senior adviser at the Treasury Department during Trump’s first administration under Secretary Steven Mnuchin. A Harvard-trained economist, Miran has been instrumental in developing Trump’s tariff policies and is widely credited as a key architect of the administration’s trade strategy. His nomination requires Senate confirmation, which faces timing challenges given the chamber’s current recess schedule and anticipated Democratic opposition. The tight timeline makes it unlikely Miran could be confirmed and sworn in before the Fed’s September 16-17 policy meeting.

These leadership changes are unfolding against the backdrop of growing internal dissent within the Federal Open Market Committee (FOMC), most notably at the July 30, 2025 meeting. Marking the first multiple governor dissents since late 1993, the committee voted 9-2 to maintain the federal funds rate at 4.25-4.50%, with Fed Governors Michelle Bowman and Christopher Waller breaking ranks to advocate for immediate rate cuts of 0.25 percentage points.

The dissents reflected philosophical divisions about the appropriate policy stance amid mixed economic signals. While Chair Powell and the majority maintained a cautious wait-and-see approach, citing “elevated uncertainty” about the economic outlook, particularly regarding tariff impacts, the dissenters pushed for more aggressive accommodation based on concerns about labor market deterioration.

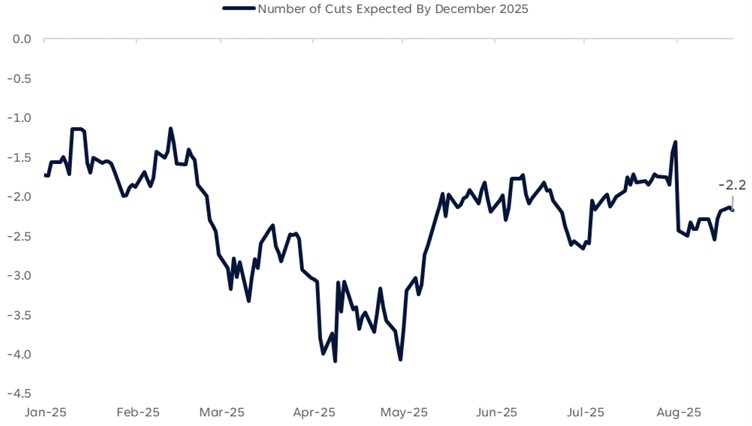

The timing of these dissents proved prescient when weaker-than-expected employment data emerged just days after the meeting. July payrolls showed only 73,000 new jobs added, far below expectations, while unemployment rose to 4.2% and prior months saw significant downward revisions. These developments dramatically shifted market expectations, with the probability of a September rate cut surging from around 50% immediately after the July meeting to over 85% by mid-August with markets now expecting two 0.25% cuts throughout 2025.

Markets Expect Two Rate Cuts This Year

Source: LPL Research, Bloomberg, 08/20/25

Past performance is no guarantee of future results.

It’s Not Just About Rate Cuts

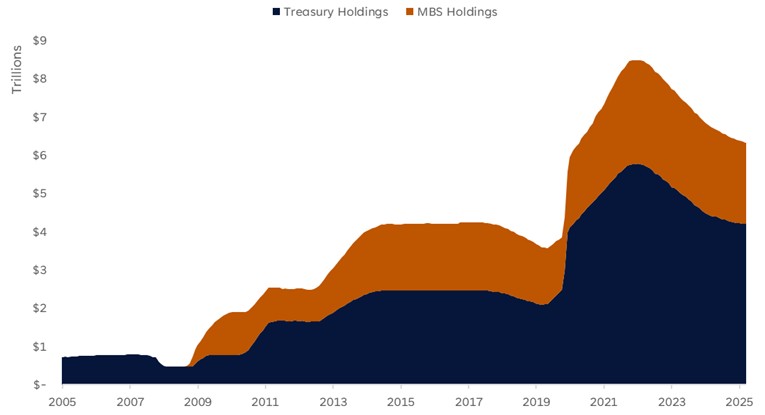

Alongside these personnel and policy debates, the Fed continues to reduce the size of its balance sheet, a less visible but equally significant component of monetary policy normalization. Since beginning balance sheet runoff in June 2022, the Fed’s total securities holdings have declined by over $2 trillion, with the balance sheet shrinking from about $8.5 trillion to approximately $6.3 trillion as of August 2025.

The current runoff operates through monthly caps that limit reinvestment of maturing securities, allowing up to $5 billion in Treasury securities and effectively $20 billion in agency mortgage-backed securities to roll off each month without replacement. This measured approach reflects the Fed’s commitment to ensuring a smooth transition from abundant to ample reserve balances without creating funding market disruptions.

The balance sheet normalization process follows a carefully choreographed exit strategy. As reserve balances continue declining toward levels the Fed judges consistent with ample reserves, policymakers will eventually halt the runoff entirely and return to modest asset purchases designed to accommodate long-term growth in currency demand and bank reserves. This transition marks the difference between the current period of quantitative tightening and the future steady state where the Fed maintains a smaller but still substantial balance sheet. The timing of this shift depends on evolving reserve demand and funding market conditions, with Fed officials monitoring money market indicators for signs that reserves are approaching scarce levels that could impair monetary policy transmission. Given current conditions, we expect the Fed to continue to shrink its balance sheet throughout 2025, absent an unforeseen disruption in the short-term funding markets.

The Fed’s Balance Sheet Will Remain Above Pre-COVID-19 Levels

Source: LPL Research, Bloomberg, 08/20/25

Past performance is no guarantee of future results.

The Broader Fixed Income Perspective

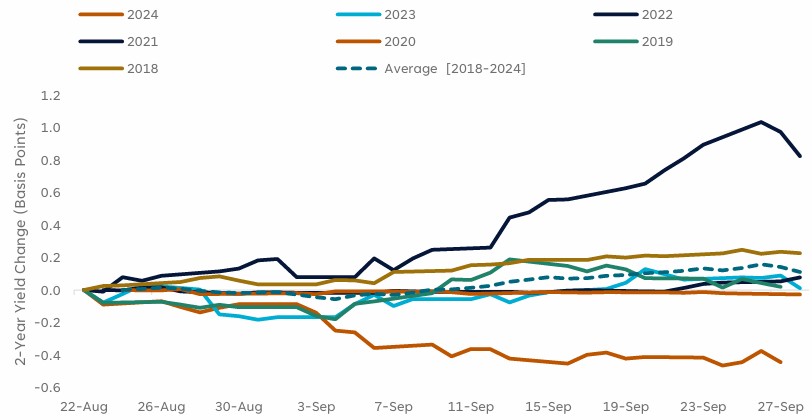

Historical patterns suggest that Jackson Hole speeches often create ripple effects through fixed income markets, with 2-year Treasury yields serving as the most sensitive barometer of Fed policy expectations. While markets have rallied in anticipation of dovish signals from Powell, the post-Jackson Hole period frequently delivers surprises that reverse initial reactions. Most notably, following Powell’s hawkish 2022 Jackson Hole address warning that fighting inflation would bring “some pain,” 2-year Treasury yields surged more than 100 basis points over the subsequent month as markets recalibrated expectations for the Fed’s commitment to restrictive policy. Although at last year’s symposium, Powell set the stage for an imminent 0.50% cut and two-year yields fell meaningfully. With markets already pricing in two full cuts in 2025, yield declines will likely be limited over the next month, absent further labor market weakening.

Two-Year Treasury Yields Tend to Drift Higher After the Jackson Hole Symposium

Source: LPL Research, Bloomberg, 08/20/25

Past performance is no guarantee of future results.

This year’s setup was particularly interesting given the growing concerns over potentially sticky inflation but also slowing economic growth — stagflation-lite in economic terms. We think economic growth (per Gross Domestic Product) could come in at only 0.3% for the third quarter, but with inflation (per the Consumer Price Index) hovering around 3% year-over-year. With Powell seemingly confirming September rate cuts while signaling a still measured approach to easing, risk markets rallied with equity and credit markets higher on the day. With credit spreads, particularly investment-grade corporates trading at levels last seen in 1998, we don’t like the risk/reward of corporate credit beta currently.

With the ongoing discussions about leadership changes at the Fed, fixed income markets will likely be watching to see the final makeup of the board. With potentially three openings (assuming Powell resigns at the end of his chairmanship term as is standard), the seven-person Fed Governor Committee would likely be positioned to cut rates aggressively. A big risk to fixed income markets, though, is a Committee that cuts interest rates for seemingly political reasons and not economic ones. In that scenario, it’s highly likely that intermediate to longer maturity Treasury yields would move higher (not lower) on the back of increased inflation concerns. With that risk still elevated, we remain neutral duration (interest rate sensitivity) relative to benchmarks and expect the 10-year yield to generally trade between 4.0% and 4.5% throughout the year.

Nonetheless, the convergence of monetary policy uncertainty, political pressure on Fed independence, and ongoing balance sheet normalization suggests that volatility across fixed income markets may persist well beyond last weekend’s symposium.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. Investors may be well served by bracing for occasional bouts of volatility given how much optimism is reflected in stock valuations, lingering tariff and inflation risks, and historical seasonal weakness. LPL Research advises against increasing portfolio risk beyond benchmark targets currently and continues to monitor trade negotiations, economic data, earnings, the bond market, and various technical indicators to identify a potentially more attractive entry point to potentially add equities on weakness.

The STAAC’s regional preferences across the U.S, developed international, and emerging markets (EM) are aligned with benchmarks. The Committee still favors growth over value, large caps over small caps, and the communication services and financials sectors.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration (interest rate sensitivity) at current levels is attractive and remains neutral relative to benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0005028-0725 Tracking #786184 | #787588 (Exp. 08/26)